Drawing on the work of Nobel Laureates in economics from three traditions, plus numerous other distinguished scholars, Cobden Centre Chairman, economist and successful entrepreneur Toby Baxendale presents an informal introduction to our proposal for honest money and the benefits consequent on the reform. See also our precis of Irving Fisher’s 100% Money.

Fact

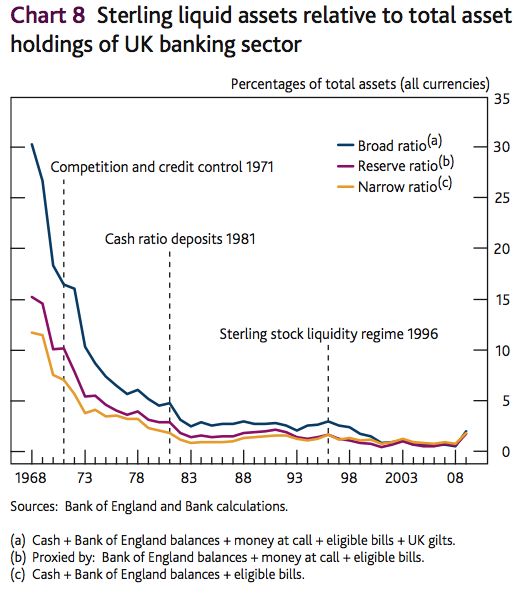

- The average overhang of credit to money of all banks in the United Kingdom is 34 x to its reserves i.e. its actual money base1.

- If more than one person in 34 walks into all banks simultaneously to withdraw their deposits, there will be a system wide bank run and a mass liquidity event with systematic default and insolvency.

- We saw the start of this with Northern Rock in the summer of 2007.

- We attempt to paper over the cracks and restore confidence in the banking system still today – with little success2.

A practical, politically-acceptable proposal

Our proposal is, as Irving Fisher wrote, “The opposite of radical”:

- Require 100% cash reserves to be held against all demand deposits; there can never be a crisis if a bank always holds 100% cash against all its demand deposits.

- Parliament can do this with one Act.

A similar Act took place in 1844. The Bank Charter Act or “Peel’s Act” established a 100% reserve requirement for bank notes that were issued claiming to be redeemable in gold. The reality was that there were 23 notes in issue for every one unit of gold at the time, creating instability, “panic” and general economic chaos. Not a too dissimilar situation from today where we have 34 claims on money to one unit of money. Politicians in the 19th century did not see the creation of unbacked credit through accounting entries as a problem, since it was only done on a very small scale. The problem then was rampant note issue (claims to real money) well over and above the monetary base, as this was the preferred method the bankers used at the time.

It is often forgotten but when you place £1m in a savings account (in cash) in say the Royal Bank of Scotland, which has no legal reserve requirement, they then lend £970k (in credit) , keeping on average 3% of cash back in reserves, to an entrepreneur in say HSBC, who then deposits that money in HSBC. We now have one claim to the original £1m and one claim to the £970k. The money supply has moved from £1m to £1.97m – just like magic! This is credit expansion.

The reality is that across all the banks in the United Kingdom licensed by the Bank of England, we have for every £1 of money (in cash), £34 in claims to money (credit)!

Peel’s problem was the over issue of notes to gold: our problem is the over issue of credit to money.

The really clever move

- One would have to print in excess of a trillion pounds Sterling to place in the banks to run against the money that has been created already through credit expansion and which now sits as deposits.

This one off act would not be inflationary, as the money (strictly speaking the money substitute or “credit”) already exists on deposit. Our proposal merely provides real cash to stand behind existing accounting entries.

- Before this Act, the banks would have a particular net worth on their balance sheets; after the act, they would have in excess of £1 trillion pounds of new net worth3.

The banks’ current assets, which they balance against their current deposits, would no longer be necessary to balance their books.

- Those current assets (loans to entrepreneurs, companies, people etc) could then be parcelled up into Mutual Companies.

- Parliament could compel these Mutual Companies to swap all the existing outstanding government debt for shares in these institutions. Government debt would then be paid down via the assets of the new mutuals.

This would end the burden on the tax payer of funding the enormous debt that has been created over the last 200 years, including the phenomenal sums that need to be raised in this Parliament and the next one. Let us pause on the fact that this government, arguably the most incompetent government in our history needs to raise some £700 billion next year alone to fund its expenditure programs. This is greater than all governments in our entire history have ever had to raise.

This would enable the government to deliver a massive tax cut as it would not have to fund the National Debt anymore. The Treasury forecasts that paying the interest on the national debt will cost taxpayers £42.9 billion in 2010/11, more than the annual budget of the Ministry of Defence. Grant Thornton, an accountancy firm, estimates that by 2013, debt interest will cost £58 billion. The income tax is forecast to generate approximately £142 billion in 2010/11. This could mean an incoming Conservative Government could give everyone a 30% tax cut, or substantially take many people out of having to pay income tax at all by raising the tax free allowance levels!

- Any surplus funds could be used to fund the pension and social security deficits by issuing bonds to cover those deficits which could be swapped for ownership in the new Mutual Companies.

We have a project in progress to formalise the relevant figures and stimulate debate.

Consider then how the consolidated balance sheet of the entire banking system would look post reform.

Consolidated Balance Sheet of All Banks Post Reform

| Assets | Liabilities |

| Assets corresponding to owner’s equity = | Owner’s Equity prior to the reform |

| Newly minted bank notes backing the deposits and supplied to banks to maintain 100% reserves = | The sum of demand deposits not exchanged for shares in the fund – the largest sum of all bank liabilities prior to the reform |

| Total of all other banking assets transferred to mutual funds managed by banks ex treasury bills held by banks as they can all be cancelled = | The sum of the new fund shares which replace outstanding government debt and the partial or total liquidation of other state liabilities, social security, pension etc. |

| Total Assets = | Total Liabilities |

The money supply is the same before and after demand deposits are backed 100% by new bills.

- Government from hence forth could be rule based. Rule 1: government must live within its means.

Government could only spend what it had taken in tax receipts: a transparent system.

- Under a system of honest money, no deleveraging can now take place. Another way of saying this is that no monetary deflation brought about by the private banking system itself can now take place.

Sterling could now be considered sound.

- The Great Depression saw a 30% contraction in the money supply of the USA, with 100% reserve, this could not happen and more importantly we would stop what is happening today.

- Also observe the very simple fact that the magnitude of the loans made by banks can only go up if there has been a prior increase in society’s voluntary savings. This means the economy would be built on save and invest. The amount of debt in the economy would be automatically set at a sustainable level.

- Remember, savings is the non consumption of present goods for the future consumption of goods that will be produced with the loans from the banking system: that is lent to entrepreneurs who will marshal the factors of production, land, labour and capital, to make these future goods.

The primary source of imbalances in the economy would have been removed.

- No longer would banks be able to manufacture profits out of nothing by lending money created out of nothing:

A “day of reckoning” would have been struck against the banks.

Some objections considered

- Banks could not lend money like they have now to promote industry.

Yes they could. They would be able to take deposits on a timed basis i.e. the depositor would deposit their savings and relinquish control over those savings, by lending to the bank for X number of months/years, so that the bank could lend to the entrepreneur / company for the same period. This is true old style and effective bank intermediation between a bank and its customer.

More importantly, when the level of savings goes up (that is when the consumer is putting more away for consumption later), the bank intermediates between the funds that are being set aside for future consumption and the entrepreneurs / companies that are seeking to provide those goods and services.

- This proposal will reduce the available credit and push up interest rates causing economic doom.

With 100% reserves, that which has been saved will be lent. This ensures the on-going co-ordination of present goods and future goods. This will stop credit created booms and busts. The marginal entrepreneur, who could have got credit in lax times, will not get it. It is those projects that are allowed to come into fruition that are the essence of boom and bust. Credit will only go where the money is most needed to satisfy future consumption needs.

Another way to say this is voluntary savings is always equal to investment, therefore bank created money (a large part of the 34x leverage to the capital base) can only bring forth projects that will never be able to be sustained as the voluntary savings are not there to buy the made goods and services. This is commonly called a bust.

- The 100% reserve system would not allow the money supply to grow to suit the growing needs of the economy.

It is argued that as economic productivity increases — i.e. every given unit of capital employed in production is producing more units than before — unless more money is created, the purchasing power of the given monetary units will go up and thus prices will fall and people will stop buying things as they will wait until the goods and services fall further. This will cause economic catastrophe.

This is the straw man of price deflation, or an increase in the purchasing power of money. So much nonsense has been expended upon this fallacy of economics. In 1989 in my first business venture I bought an Apple Mac for £3,000. It was my first PC, used to help me drive efficiencies in the business. Would I have waited until 2009 to buy one for £500 in the full knowledge that they would become cheaper as Apple would become more productive at producing more of them? Hell no! Would my grandfather have waited 80 years to by a cheaper car in real purchasing power terms and forego all the advantages of owning a car for 80 years? Hell no!

As with all price deflation, I am delighted that the purchasing power of my money has gone up: which allows me to buy more things!

As the governments have systematically allowed the purchasing power of money to fall by over 99% in the last 80 odd years because they have allowed the practice of money creation via the banking system to take place and have printed money themselves (“Open Market Transactions” or “Quantitive Easing”) via their Central Bank, a period of raising purchasing power of money would be most overdue!

- Does not the implied government guarantee behind all deposits actually create the same effects as the 100% reserve system?

No. This is because the bankers’ can still create money out of thin air and lend it to whoever they like with the knowledge that the State will bail them out should the loan go bad. The moral hazard created in this process is enormous. What we need is bankers who respond only to the lodging of voluntary savings, who then lend them out to entrepreneurs / companies for their activities as these will be more sustainable than lending with an implied guarantee from the taxpayer.

- The banks often claim that they do only use deposits to fund loans so they are in effect very solvent and only illiquid for timing purposes (site the Select Committee Comments by the notorious RBS and HBOS Bankers) so what is the problem?

You have to have your current assets (loans to entrepreneurs / corporations, mom and pop individuals etc) backed by demand deposits, this is true. The point being if I deposit £100 of real cash in notes and coins into a bank, then the bank that has got this deposit, then lends all but 2.94% of it (1/34th of 100) out again. This is the average Reserve Ratio of all licensed banks licensed by the Bank of England. In effect, £97 pounds of the original £100 gets lent to an entrepreneur.

So now we have the original £100 and £97 lent to the entrepreneur and £3 kept back in reserves. The bank’s asset, the loan, is equal to the current liability, the deposit. Therefore the bank’s balance sheet balances.

The trouble comes when the entrepreneur deposits his new £97 borrowed in a new bank, and the same process starts again until the last penny over 2.94% of a whole series of transactions is completed. So on the face of it, they all seem to have deposits that are lent to good security. In reality, if I wanted my £100 back, along with every one else, we would only get 2.94% of it. Thus, by any normal definition, all of the banks are insolvent.

By law, banks are allowed to run on an insolvent basis by any normal commercial standards and the law allows them to describe themselves as solvent. In truth, they are legally solvent until people want their money back, then even under any understanding they become at least illiquid or to the common man: insolvent! So without a “lender of last resort” — and the Bank of England ceased to be this in its failure to lend to Northern Rock in August 2007 — we are in a very precarious situation.

- If the Peel Act was so effective why was there bank runs and booms and busts after that?

Up until the total link with Gold was abolished in 1971, Bank of England Notes were backed with gold. From the Peel Act of 1844, no one has ever had any trouble redeeming in gold as far as I am aware. So the Act was effective.

What it did not do, was seek to regulate the growth of demand deposits. It was this oversight that has caused a significant growth in the money supply that can be directly correlated with National Income. Broadly speaking, when deposits are growing, we “boom,” when they are shrinking, we have a “bust.”

Tim Congdon in “Central Banking in a Free Society” 2009 and “Money and Asset Price in Boom and Bust” of 2005, both published by the Institute of Economic Affairs, very ably demonstrates this, although the author does not agree with 100% reserve systems we propose. He would prefer the reestablishment of the pre 1946 Bank of England owned not by private individuals, but by all banks like the Federal Reserve in the USA, which for sure would be a better arrangement than we have today, but not the ultimate solution, which I propose in this paper.

- Would not financial innovation just create another method whereby the Banks could lawfully re create the same effect as the over issuing of notes over specie or the uncontrolled growth of demand deposits and render your whole 100% Reserve project ineffective?

Yes, that may well be the case and it should be the job of law makers to not wait 165 years to stop it!

Afterthought

At present, a saver thinks they own their demand deposit. Since Carr v Carr 1811, it is clear in English Law that the bank in fact owns the deposit and can do with it what it likes. You as a saver think you own this money. Two people cannot own one bit of property.

In this country, 34 people think they own the same one bit of property in the banking system. This system is rooted in a flagrant abuse of private property. Addressing this single issue – the sole cause of the Boom Bust environment we occupy, will prevent all the effects that have happened in this current boom and bust. By this, I mean the claim that sub prime , credit default swaps, various derivatives, too much saving in China etc are effects of the uncontrolled credit creation by banks. None of these events could have happened without the credit to support them.

As legal tender in this country is Sterling and can only be created by the Bank of England and in effect its branch network (the private banks that it licenses), the only cause for this boom / bust is lack of control by Gordon Brown and his Government. The cause, that no one mentions, or possibly understands is the other half of the problem that Peel dealt with 165 years ago. Resolve this omission and we will have a very stable financial system and a much more prosperous and fair economy.

This shows thank our leading bankers either were disingenuous to the Select Committee, or they were genuinely ignorant as to the whole process of credit creation in the — their! — banking system, or just plain fibbers.

Further Reading

- Our literature, particularly the final chapter of Huerta de Soto, Money, Bank Credit and Economic Cycles

- What is money? — a better measure of the money supply

- The Problem with GDP — a better measure of prosperity

- Irving Fisher, 100% Money, 1935 — a precis of Fisher’s proposal for 100% reserves

- The kindness of geniuses — on planning and markets — and Economic Interventionism, Banks and the Crisis

- FT.com — “Wall St profits from Fed role” — how QE widens wealth inequality and damages the economy

- How economic thinking becomes entrenched and a fresh perspective

- Our archive of Insight Articles

- Speech by the Earl of Caithness in the Banking Bill debate 2009

You can also:

- See the Bank of England’s Financial Stability Report. Oral evidence from Sir Fred Goodwin (RBS) and Mr Andy Hornby (HBOS) to the Treasury Select Committee was at variance with our calculations:

Q1864 Mr Love: Sir Fred, can I ask you, following on from those questions, how leveraged was RBS at the time of the Lehman’s dissolution?

Sir Fred Goodwin: I think there would have been a variety of different ways of looking at the leverage ratio.Q1865 Mr Love: I am just looking for a rough idea, order of magnitude.

Mr Fred Goodwin: Towards the higher end but there would be others higher than us. We would have loans to deposit.Q1866 Mr Love: What was the ratio?

Sir Fred Goodwin: 110% but there would be others similar to that, there would be some higher and some lower. We were to the right of the middle, we were at the higher end of the middle.Q1867 Mr Love: Mr Hornby, can you tell us what it was for HBOS?

Mr Hornby: Yes, our loans and advances were around £450 million, our customer deposits were about £250 million, therefore the percentage of one to the other was around 57%.See http://www.publications.parliament.uk/pa/cm200809/cmselect/cmtreasy/144/144i.pdf – Page EV246, Q1864 [↩]

- See for example, Caithness, “My Lords, the Banking Bill which we are currently discussing in the House is very complex and detailed, but it does nothing to resolve the current banking crisis, which lies at the heart of our economic problems. The noble Lord, Lord Peston, has just said that it is the fault of the bankers. I agree with him up to a point, but would go further and say that the fault that really needs correcting is our whole banking system.” [↩]

- the figure could be as high as £1.7 trillion depending on how the money supply is measured , but that is another debate for another day [↩]

Comments are closed.