According to the mainstream press, the reason behind the present sell-off in commodities – and in many so-called ‘risk-assets’ (stupid really, all assets are risky) – is weak growth, not tighter monetary policy. At least this is how I interpret the market commentary in the Financial Times and the Wall Street Journal. The mainstream media often gets it wrong – but let’s assume for a minute that they are right. What does it mean?

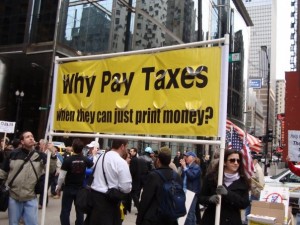

Super-easy money was supposed to ‘stimulate’ us into recovery. In fact, it is causing input prices to rise, which in turn squeezes profit margins and chokes off the recovery that easy money was supposed to bring. Now the faltering recovery in turn undermines commodity prices.

Again, we see that, two years after the US recession officially ended, nothing has been solved. Our problems are still with us. In the meantime, the trade-off between growth (even growth of the artificial and therefore short-term type) and inflation is getting progressively worse. The UK offers a powerful illustration of this: again the Bank of England had to revise inflation up and growth down. Her zero-interest rate policy is boosting prices with little lasting effect on growth. It goes to show that once your economy is out of whack because of distorted prices and misallocations of capital as a consequence of previous money injections and excessive indebtedness, you can’t easily get out of this mess by printing more money and keeping rates artificially low for even longer. Bottom-line: the global economy is still very weak. The ‘recovery’ is feeble or non-existent.

Commodities are now correcting because there was too much hot money in them, or because they ran too much ahead of other prices in this mega-trend of inflation that we now entered, thus undermining demand for them.

If this were purely a commodity phenomenon, equities should rally. Lower commodity prices mean lower input prices and higher profit margins. However, equities are presently correcting as well. This is further indication that what is behind this move is concern about the recovery. If that is true, and if it lasts, we won’t see the monetary tightening that is now being talked about. Instead we may see more easing – and then commodities will rally again.

Last week, Trichet already forgot to mention ‘vigilance’ in one of his speeches. If unemployment stays high in the US, and the equity market comes under pressure again, it is only a question of time until we get QE3. Remember, The Bernanke made it his declared goal to boost the economy via high asset prices, including equity prices, thus benefiting Wall Street and the upper echelons of US society whose paper gains would then trickle down to the regular folks – he may have put it somewhat differently. In any case, if the economy is weak, we will get more monetary stimulus – and thus higher commodity prices, in particular a higher gold price.

Continue reading at Paper Money Collapse.