I am something of a gold bug, believing that gold (and silver) represent the best way to preserve wealth in inflationary times as well as representing a fantastic opportunity for speculation.

So, I was delighted a couple of years ago when George Soros bought a whole load of the stuff. “Great minds etc…”

But then, the other week, came the news that he had sold it all. The silence amongst gold bugs has been deafening. About the only response I have seen was to the effect that although Soros was small in bullion, he was big in mining. But my back-of-an-envelope calculations tell me that this is gibberish – his mine holdings are nothing like the size of his former bullion holdings. The truth is that Soros has sold.

It is possible that what he has done is to get out of ETFs (a sort of fund) and into actual physical metal (a certain sort of gold bug will tell you there is a crucial difference). But I would have thought that would show up in exactly the sort of records that told us he had sold. (I am not an expert here so I would love to know).

It is also possible that he thinks there is going to be a confiscation like 1933. But wouldn’t he be bigger into mining stocks? And anyway, what are the chances of a confiscation with a divided Congress? Sure, the Republicans in the House seem to be reluctant to do anything sensible (like keeping the debt ceiling where it is) but equally they don’t seem too keen on doing anything stupid either. There might be a confiscation here, in Britain, but not in the US.

I suppose it could all be a bluff to depress the price. Maybe, but so far it doesn’t seem to have worked.

Or maybe Soros is simply stupid. But I don’t think Soros does stupid. I may not agree with his politics, but his reading of finance is normally spot on.

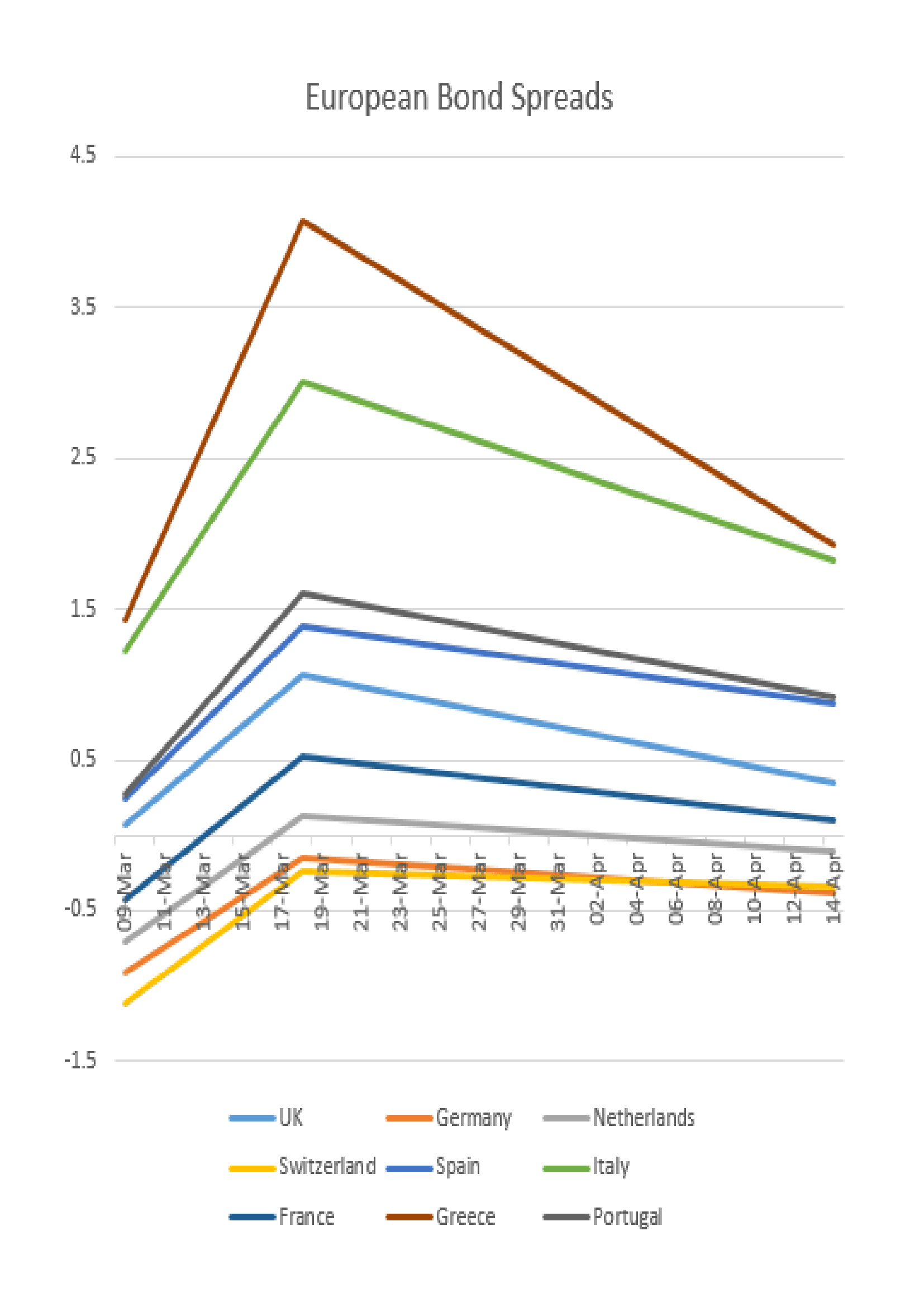

Perhaps he’s looking at the situation in Greece. Perhaps he thinks Greece is about to default. Greece defaulting is likely to be very like Lehman going bust – just bigger. When Lehman went bust just about all asset classes (including gold) fell as people got desperate for cash. If Greece goes the same way there are going to be some wonderful fire sales. Only later will governments carpet-bomb the planet with out-of-thin-air cash leading to a further boost to the gold price.

Maybe, maybe, but I really don’t know. Any ideas?

My understanding is that he sold ETFs, and bought gold companies’ shares: http://www.telegraph.co.uk/finance/personalfinance/investing/gold/8524535/George-Soros-sells-his-gold.html

And I’m unaware of any filing needed to the SEC for buying physical…. And who knows what other opportuniites come into his in-tray every morning that look even better, eg real companies that create value rather than stuff that just stores it.

And you can never knock a man for taking a profit.

When I said “mining” what I meant was gold mining. The problem is that IIRC he sold $500m of gold ETF shares and bought $15m of gold mining shares.

Interesting point about SEC filings.

In my opinon, Soros is an evil, manipulative man. The closest thing on this planet to a James Bond-style megalomaniac.

Personally, I’ll continue to buy gold and silver. Soros is trying to manipulate the system (as usual). Hard money is still the way to go. Just look at the increasingly dire state of the fiat currencies.

I’d rather place my trust in Peter Schiff than George Soros.

I don’t think there’ll be another confiscation. In ’33 the dollar was gold backed, so the government couldn’t issue more dollars without obtaining more bullion. That’s obviously not the case today. There’s no more reason for the government to steal your gold than any other commodity.

I agree Ray. Governments are now much more sophisticated in the way that they confiscate our hard earned money. By relying on fiat paper, debt, and a wall of lies, governments have managed to convince the majority that rising prices are not caused by monetary debasement, but are instead caused by speculators. It is a complete joke.

The only danger with gold and silver is that one day governments may feel they have no choice but to jack up interest rates to save their ability to print money. In which case gold and silver will crash, much like they did in 1981 when Paul Volcker saved the dollar with 21% interest rates.

The problem with trying to protect your wealth is that a few highly intelligent lunatics have all the power of the state behind them, and a desire to rob all of us of much as they can for their own selfish ends, be they political or financial.

One day, governments may confiscate gold (and perhaps silver) in order to shore up their failing currencies. The Australian banking act has built-in provision for gold confiscation.

I don’t think that’s why Soros sold his gold though. I’m no expert either but apparently there’s a lot of speculation in commodities including the precious metals. It appears that increases in margins causes silver’s recent drop in price. Gold doesn’t appear to be pumped up as much as silver though… With so much speculation/leverage, if there’s a greek default or some other big event (that Soros has an inkling of), then there’s likely to be a lot of covering going on?

Maybe Soros hopes to get back in after a bounce? Could be that a friend wanted him to signal to the world that gold isn’t that important :)

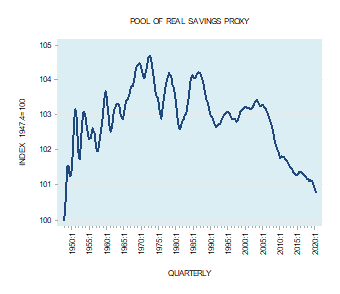

I still haven’t been able to get an answer to the all important question. Does QE result in an actual increase in the money supply or is it preventing a decrease?

If prices continue to rise (not actually inflation) people will have less money (wages ain’t rising)for things like paying their debts or if they pay there debts in preferance to buying things they will have less money available to spend which means prices will need to come down (which is not actually deflation) but it could increase the rate of reposessions and that is deflation, because most of the money supply is credit and most of that is secured on assets that arn’t marked to market.

The Greece situation is interesting because it seems that the negotiations are revovling arround how to default without triggering credit default swaps. It’s a catch 22 as triggering CDS would crate a major credit problem and not triggering them would mean that a CDS were worthless and that would create a major problem as well.

In a deflation which is a decrease in the money supply reletive to goods you sell assets because you can buy them back cheaper later. George Soros is not an idiot and he probably knows the answer to my question.

Much depends on what you call money. However, in the main, QE has prevented a decrease in the US. The effect of their policies in conjunction with the Chinese policies, however, has resulted in a massive increase in money supply in China, which is why this nation faces inflation, it is why gambling revenues in Macau are up 50% year on year for the second year running, it is why Chinese have an enormous housing boom and it is also why house prices in areas such as Montreal are at extraordinarily high levels, with 80% of buyers apparently mainland Chinese. It also explains why Chinese people have been buying silver and gold.

For my money, you are right when you state: “When Lehman went bust just about all asset classes (including gold) fell as people got desperate for cash”

Just because there is a long-term inflationary trend, this doesn’t mean that it will be a one-way inflationary trend. The authorities are well-aware that if they show flagrant disregard to the health of their fiat currencies, then this will result in no one using them anymore, which is the essence of hyperinflation.

The authorities would like to inflate without you noticing. When -therefore – inflation expectations get too entrenched, then of course they will attempt to rein these expectations back. The problem with this is that the financial sector is so over-extended in so many parts of the world that this will cause a deflationary accident. Hence, the likely path through this is one of see-sawing inflation and deflation, probably with an inflationary bias.

QE II is finishing and all the Asian nations have a significant inflation problem. It is likely, therefore, that inflation will subside from here, which could be nasty for all risk assets, to which gold is currently behaving similarly.

It is possible that Soros has decided that gold has nowhere to go but down. The massive run-up in gold prices combined with the soft market conditions and low growth make for uncertainty and large swings in commodity prices. QE2 is also over, which should create a kind of “wait-and-see” attitude as inflation will only come about if there is a supply shock or if another asset bubble forms.

On a related subject, I liked Andrew Lilico’s analysis of recent failures to meet the 2.5% CPI target.

http://blogs.telegraph.co.uk/finance/andrewlilico/100010452/the-uks-inflation-target-is-now-a-piece-of-surrealist-theatre/

The Gold Confiscation of 1933 is the single most draconian economic act in the history of the United States!