In his latest article for ConservativeHome, Steve Baker highlights the economic benefits of low, flat taxes:

Our austerity programme only deals with the deficit over five years, not the debt. We know we must lift our country’s economy and spirits in the context of an awful legacy. We know the public must continue to pay the British state’s inflated bills. We know we must create jobs. A flat tax would be an efficient way to set about it.

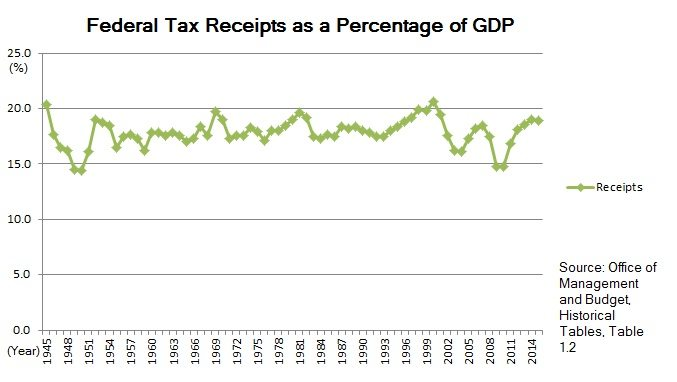

According to The Adam Smith Institute, countries which have introduced flat tax have increased tax revenue. The better off pay a lower rate than before, but higher total amounts and a higher percentage of the total tax take as the economy flourishes.

A flat tax would deliver simplification – an aim expressly included in the Coalition Agreement. It would do away with a huge amount of HM Revenue and Customs’ bureaucracy and wearisome headaches for millions of taxpayers. Capital stashed away would return from abroad. In a low, flat tax environment, many people would revert to simply paying the tax instead of buying expensive avoidance schemes from experts.

As usual, the whole article is well worth reading.

No. Simpler ways to pay are not the issue. The amount paid by varous groups is not the issue. The issue is that taxes are ot voluntary. See here for the case for voluntary taxes. http://bit.ly/kpTMVa